Telecom operators have ability to change and adapt quickly to the fast-paced times in which we live. This market speed is essential for survival, since competition is fierce. Telcos began their journey as highly specialized companies that offered either telephone, internet, or cable services to their customers, but exited the 90s already offering bundled services of products, such as fixed and mobile telephone lines, cable TV and Internet. Then smartphones disrupted the market, and Telcos were forced to reinvent themselves. Voice and messaging, their core services, were quickly overcome by data, and their role as service providers changed. They had to look for new ways to identify and leverage the new market potential, expanding their offering and business lines according to consumers’ new demands.

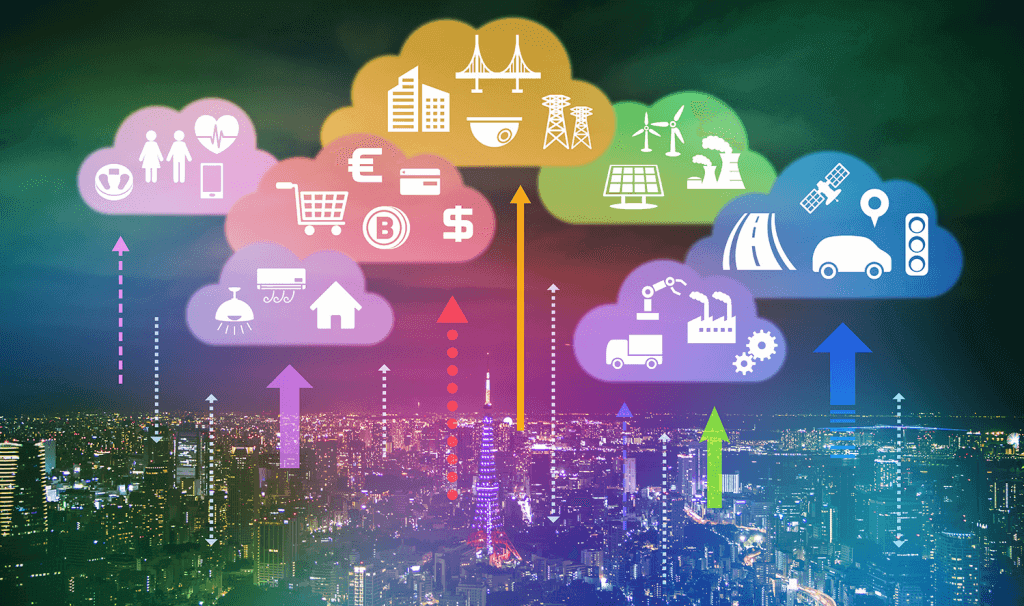

As the smartphone market matures, Telcos have realized the need to again adapt and have turned their sights towards the new revolution: IoT. Here they have seen the possibility of expanding even beyond the concept of traditional communication and content services. The possibilities afforded by IoT in the home are multiple, and yet to be realized. Due to their own nature, Telcos are in a privileged position to decide what role they want to play in this nascent market. They can choose to become “distributors, enablers/integrators, and, in some cases, even providers” of all types of connected living services. For that same reason, Gina Narcisi from CRN considers them to be “in the perfect place to tie the moving parts together for end-to-end solutions.”

A 2015 report by research firm IDC concluded that “Telcos will play a critical role in building up the M2M/IoT market.” The opportunities in the IoT space are there for Telcos to take them… if they haven’t already. In fact, the trend is fairly consolidated among US Telcos, and yielding growing benefits. AT&T, for example, has been offering professional smart security and smart home services for a while now, through their AT&T Digital Life Home. AT&T and Comcast, which are two of the most powerful Telcos in the country, have already achieved more than half a million subscribers by expanding into this type of connected services.

European Telcos, on the other hand, still lag behind, trying to set foot in a market very different from their American counterparts, and thus using a different approach. Many are beginning to offer a wide range of products to their customers (smart lighting, smart plugs, security cameras or heating controls) or end-to-end solutions that they bundle with their regular services, such as broadband and mobile connectivity.

One field where Telcos are already making progress is digital or connected healthcare services. We have the case, for example, of Telefonica’s Saluspot, an interactive community where users receive online health advice and consultations from qualified doctors, or Telecom Italia’s Nuvola It Digital Clinic —a new service for health facilities for managing electronic medical records—, and Nuvola IT Home Doctor, to remotely monitor patients at home. This trend is not exclusive to the US and Europe. In Asia, we have the example of Norwegian telecom giant Telenor, which last June launched Tonic, a digital health service for emerging Asian markets. These are just a few examples of a clearly growing trend.

There have also been incursions in the connected cars market. In 2014, Vodafone acquired Cobra Automotive Technologies, aiming to become a global provider of connected car services for vehicle manufacturers, insurance companies and fleets. Another case would be that of Telia Sense, from Swedish Telco Telia, which launched its first connected car solution in 2016.

But if there is one market where European Telcos have their sights set, it is connected home energy management. Many of them are already offering their customers energy saving devices such as smart plugs or smart thermostats, either as part of an ecosystem of products or as standalone devices, such as Swisscom’s heating control system Tiko.

Many industry experts agree that one of the best opportunities for Telcos who are considering to offer connected home services to their customers lies in Big Data analytics —as they are in a privileged position to collect high volumes of information from a large customer base. “Utilizing Big Data analytics with dedicated Smart Home solutions, carriers are able to analyze existing customers’ behaviors and identify those most suitable to target for new Smart Home services.” Indeed, Telcos have a very valuable asset in the fact that they are already present in millions of homes in the countries where they operate. This is not solely for the vast volumes of data they can gather, but also for the fact that customers would always prefer to acquire a new product, device or solution from their trusted operator than from an unknown third party. Also, with all the customer service and distribution channels in place, it is comparatively easy for them to offer their current users new products and services.

But although expansion into these types of connected living services provides Telcos with the possibility of offering their current customers new services and attract new customers, it also presents some significant challenges. To succeed, they will have to educate consumers and change their market perception, so that users view them not just as their mobile, broadband and cable carriers, but as Connected Living service providers. And they will have to move fast. When one Telco pioneers in a field and succeeds, others are quick to follow its lead. But being first to get there counts. Customers love innovative companies that offer them what they need, sometimes even before they realize they need it. As Jennifer Goforth Gregory, from IMB Analytics, puts it, “the IoT is dramatically changing consumers’ wireless demands, and therefore providers’ service levels. It is essential that these companies understand the opportunities and challenges created by the IoT, and then craft a strategy for this next generation of smart devices.”

Telcos have to actively take part in this new market ecosystem or risk becoming ‘dumb pipes’ by providing others with the conduit for OTT services. This is of course a challenge for Telcos, which entails risk, investment and much hard work. but this is not the first time —nor it will be the last— that Telcos have had to reinvent themselves to thrive.